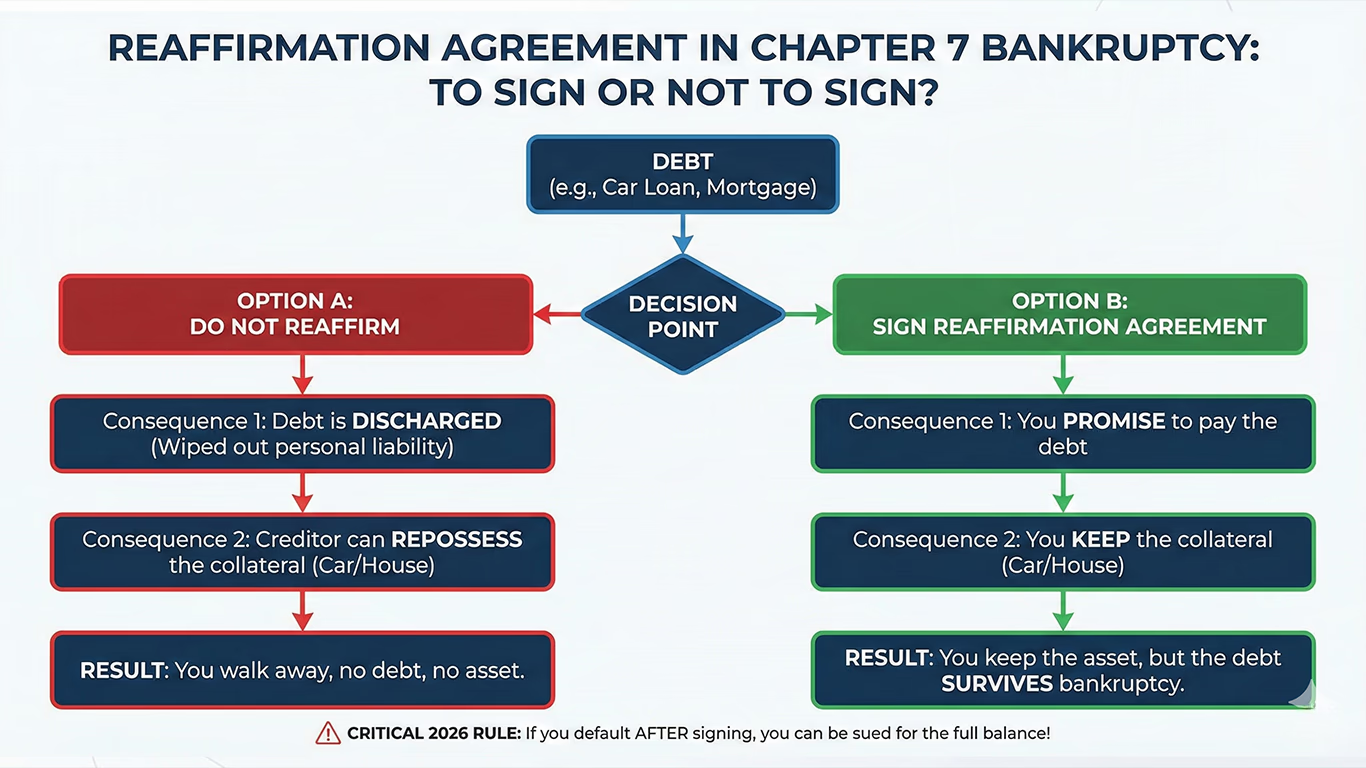

Filing for Chapter 7 bankruptcy is about getting a “fresh start.” The goal is to wipe out your debts and move forward. But what happens when you want to keep something that has a loan attached to it, like your car or your house? This is where a powerful, and often misunderstood, document comes into play: the Reaffirmation Agreement.

For many of our clients in 2026, this is one of the most stressful decisions in the entire bankruptcy process. It’s a legal crossroads: Do you walk away free and clear, or do you voluntarily re-shackle yourself to a debt you were about to eliminate?

This guide will explain exactly what a reaffirmation agreement is, why creditors push for them, and the critical risks you must understand before you even consider signing one.

What is a Reaffirmation Agreement? (In Plain English)

Imagine your bankruptcy discharge as a giant eraser that is about to wipe away your personal liability for your debts. A Reaffirmation Agreement is a contract you sign with a creditor that says:

“Wait! Don’t erase this specific debt. I promise to keep paying it, just like before, as if the bankruptcy never happened.”

It is a voluntary agreement. No one—not your creditor, not the court, and certainly not your attorney—can force you to sign it. It is typically used for “secured debts,” which are loans backed by collateral like a vehicle or a home.

The Core Dilemma: Keep the Car or Ditch the Debt?

When you file Chapter 7, you have a choice regarding your secured debts. Let’s use a car loan as the most common example.

The “Ride-Through” Option (And Why It’s Risky)

In some jurisdictions and with some lenders, there used to be a “ride-through” option: you could keep the car and make payments without signing a reaffirmation agreement. If you defaulted, they could only take the car, not sue you.

Under current bankruptcy laws in 2026, the “ride-through” is largely dead. Most creditors will repossess the vehicle immediately after your bankruptcy case closes if you do not sign a reaffirmation agreement or redeem the vehicle. Do not count on this option without explicit legal advice.

The Serious Risks of Reaffirming in 2026

As your attorneys, we are often very hesitant to recommend reaffirmation agreements. Here is why they are so dangerous:

- ⚠️

You Re-create Personal Liability: If you reaffirm a car loan and then lose your job six months later and can’t pay, the lender will repossess the car, sell it at auction for a fraction of its value, and then sue you for the difference (the “deficiency balance”). You will be right back in debt, and you cannot file Chapter 7 again for another 8 years. - 📉

It’s Often a Bad Financial Deal: You might be reaffirming a loan on a car that is “underwater” (you owe $20,000 on a car worth $10,000). You are essentially agreeing to pay double what the car is worth, right after getting a fresh start.

When MIGHT it Make Sense to Reaffirm?

While risky, there are limited scenarios where a reaffirmation agreement *might* be considered, but only after careful analysis:

| Scenario | Why Reaffirm? | Attorney’s Take |

|---|---|---|

| The Loan has Great Terms | You have a 0% or very low-interest loan that you could never get again post-bankruptcy. | Possible, if the payment is easily affordable in your new budget. |

| You Have Equity | The car is worth significantly more than what you owe. | Maybe. But if you have equity, you could also sell it, pay off the loan, and buy a cheaper car for cash. |

| The Creditor Offers a Better Deal | Some creditors will lower your interest rate or principal balance as an incentive to sign. | Worth considering. This is the only time we strongly advocate for a review. |

The Process and Your Safety Net (Rescission)

The Court’s Role

A reaffirmation agreement must be filed with the bankruptcy court. If you are not represented by an attorney, or if the agreement creates a budget deficit (your expenses exceed your income), a bankruptcy judge must hold a hearing to approve it. The judge will only approve it if they believe it’s in your best interest and does not impose an “undue hardship.”

The “Oops” Clause: Rescission

You can change your mind. You have the right to “rescind” (cancel) a reaffirmation agreement.

You must notify the creditor in writing that you are canceling the agreement. This must be done before the bankruptcy court enters your discharge order OR within 60 days after the agreement is filed with the court, whichever is later. This is a strict deadline.

Conclusion: Do Not Sign Without Legal Counsel

A Reaffirmation Agreement is one of the few ways you can sabotage your own fresh start. Creditors will pressure you. They may send you the agreement with a threatening letter.

Never sign a reaffirmation agreement without having your attorney review it first. We need to analyze your budget, the value of the collateral, and the terms of the loan to ensure you aren’t making a mistake that will haunt you for years.

Facing Pressure to Reaffirm a Debt?

Don’t let a creditor bully you into re-signing a bad loan. Let us evaluate if keeping the asset is truly worth the risk to your financial future.

Gracias a su apoyo pude organizar mi situación financiera y atravesar este proceso con confianza y esperanza.

Lo recomiendo 100 % a cualquier persona que necesite un abogado de bancarrota responsable, comprometido y verdaderamente interesado en ayudar a sus clientes.

¡Mil gracias por todo, abogado Burgos!

Fighting For Your Rights

To ensure you receive what’s owed to you

More than a decade of expertise in Auto Accidents and Bankruptcy Law

Free Consultation

Results may vary depending on your specific facts and legal circumstances.